Efficiency and accuracy in billing processes are crucial. One of the most significant advancements in this area is E-Invoicing, which offers a streamlined approach to managing invoices between suppliers and buyers.

What is E-Invoicing?

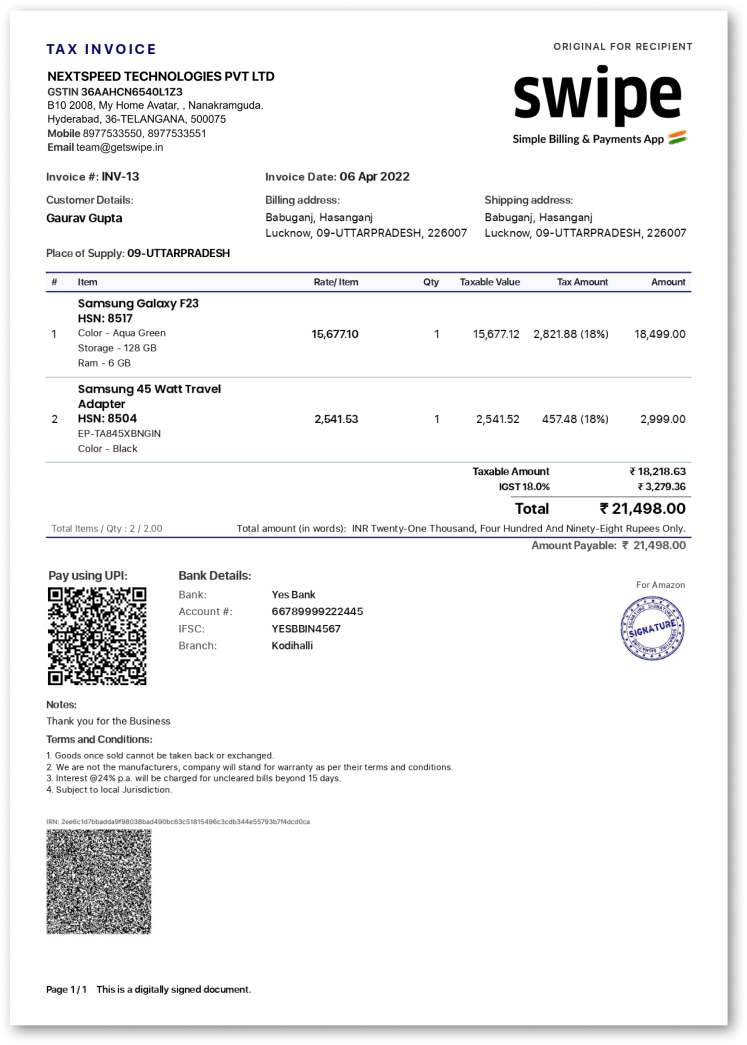

E-Invoicing, or electronic invoicing, refers to a system where B2B invoices and a few other documents are electronically validated by GSTN before being used on the shared GST portal. E-invoicing refers to uploading a standard invoice that has already been digitally prepared, rather than creating invoices on the GST portal.

Every invoice under the electronic invoicing system will have an identifying number attached to it by the GST Network-managed Invoice Registration Portal (IRP) (GSTN).

Real-time transfers of all invoice data are made from this e-Invoice portal to the GST and e-way bill portals. Because the data is sent straight from the IRP to the GST portal, it does away with the requirement for human data entry when generating part-A of e-way bills and filing GSTR-1 returns.

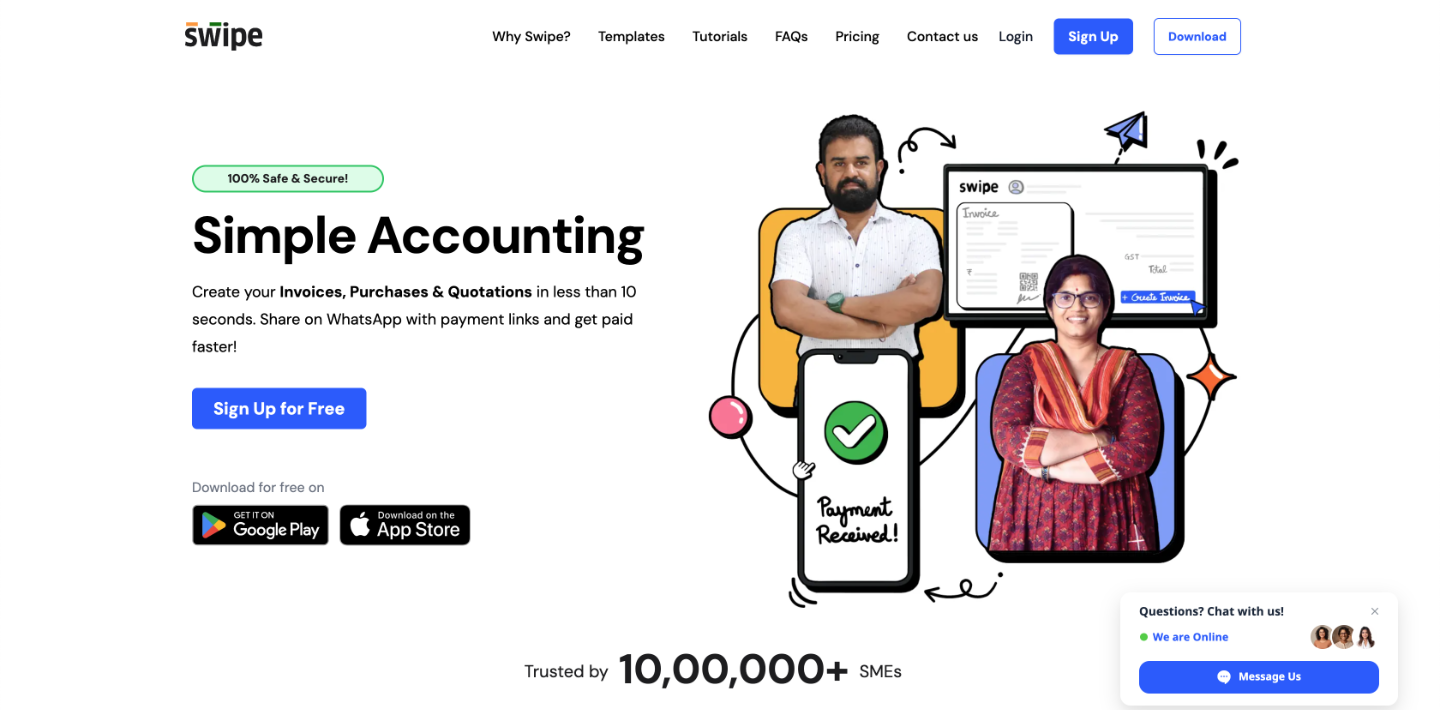

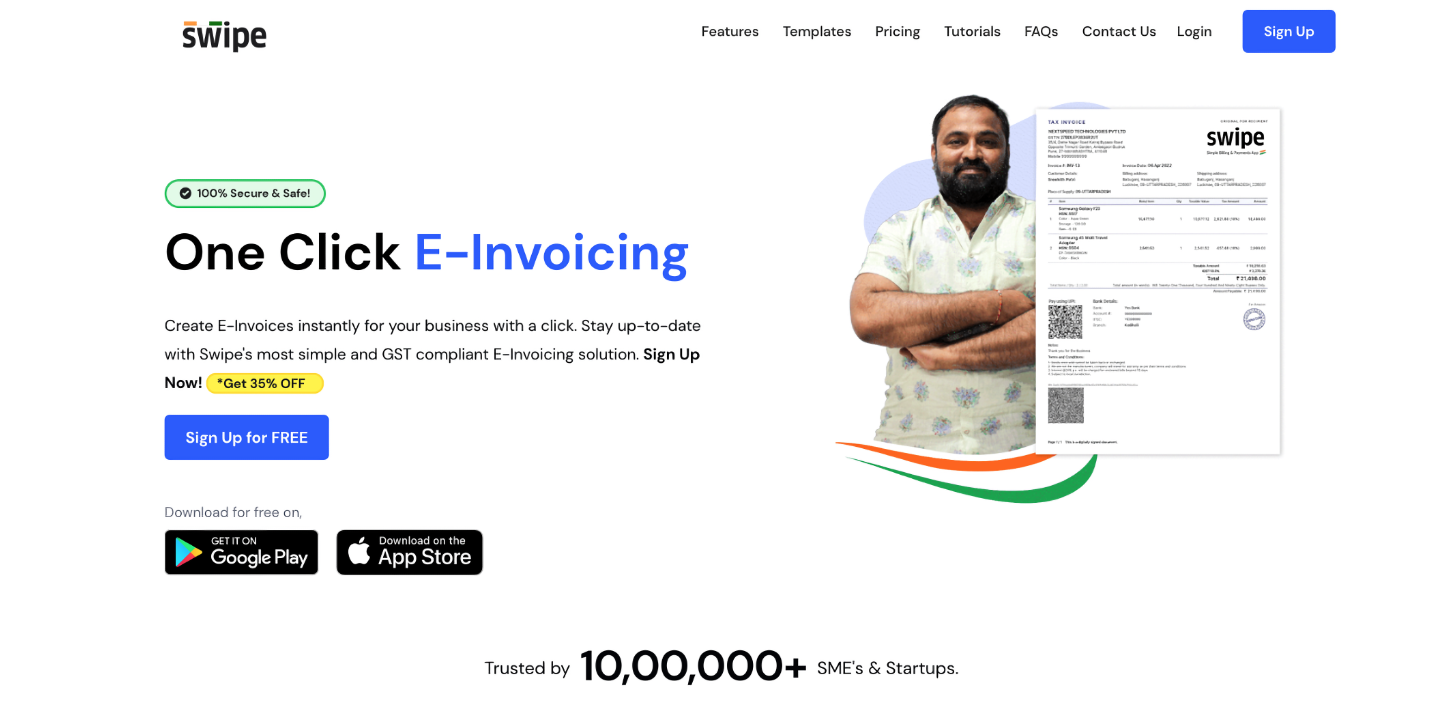

Why Swipe is best for e-invoicing?

The process of E-Invoicing typically involves several key steps:

- Creation of Invoice: The supplier generates an invoice using their accounting or billing software.

- Submission to IRP: The invoice is then submitted to the Invoice Registration Portal (IRP) for validation.

- Validation: The IRP checks the invoice for compliance with GST rules and ensures all necessary details are included.

- Generation of IRN: Upon successful validation, the IRP issues an Invoice Reference Number (IRN) which serves as a unique identifier for the invoice.

- Transmission to Buyer: The validated invoice, along with the IRN, is sent to the buyer’s system for processing.

- Storage and Retrieval: Both parties can store the electronic invoices for future reference and audits.

By automating these steps, E-Invoicing reduces the time and effort required to process invoices while minimizing errors that can occur with manual handling.

Who Needs E-Invoicing?

E-Invoicing has been mandated for various businesses based on their annual turnover. Initially, businesses with a turnover exceeding 50 crores were required to adopt this system. As of April 1, 2022, this requirement was extended to include businesses with a turnover greater than 20 crores. Furthermore, from October 1, 2022, businesses with an annual turnover exceeding 10 crores are also mandated to implement E-Invoicing.

Looking ahead, starting January 1, 2023, there may be further expansions requiring businesses with an annual turnover exceeding 5 crores to comply with E-Invoicing regulations. This phased implementation highlights the government’s commitment to digital transformation and efficient tax compliance.

Documents Required for E-Invoicing under GST

For businesses to successfully implement E-Invoicing, certain documents must be prepared and submitted:

- Invoice by Supplier: The core document detailing the transaction.

- Debit Note by Supplier: Used to record a reduction in the amount owed by the buyer.

- Credit Note by Supplier: Issued when a buyer returns goods or when there is a pricing correction.

- Additional Documents: Any other documents mandated by law must also be uploaded to the IRP system by the taxpayer.

Having these documents ready ensures that businesses can comply with E-Invoicing regulations without delays or complications.

Benefits of E-Invoicing

The transition to E-Invoicing brings numerous advantages:

- Improved Accuracy: Automated data entry minimizes human errors.

- Faster Processing: Invoices can be processed instantly, speeding up payment cycles.

- Cost Efficiency: Reduces paper usage and storage costs associated with physical documents.

- Enhanced Compliance: Automatic generation of IRN helps maintain compliance with GST regulations.

- Better Cash Flow Management: Timely invoicing leads to quicker payments from buyers.

Conclusion

In conclusion, transforming your billing process with Swipe E-Invoicing can significantly enhance your business operations. By embracing this digital approach, companies can ensure smoother transactions, improved accuracy, and greater compliance with regulatory requirements. As the landscape of invoicing evolves, adopting E-Invoicing is not just beneficial; it is essential for businesses aiming for success in today’s competitive marketplace.